Stock Market Returns by Presidential Party

The New York Times recently published an “Op-Chart” by Tommy McCall on its Opinion page showing what your returns would have been had you started with $10,000 in 1929 and invested it in the stock market, but only during the administrations of either Democratic or Republican presidents. His calculations showed that if you had invested only during Republican administrations you would now have $11,733 while if you had invested only during Democratic administrations you would now have $300,671. Twenty-five times as much!

That’s a pretty dramatic difference, but does it stand up to a closer look? Is it even mathematically plausible that you could have essentially no return on your investment at all over nearly 80 years, just by choosing to invest only during Republican administrations?

To answer these questions, I of course turned to Mathematica.

And the answer is that yes, it is mathematically plausible, using the assumptions made by McCall. My analysis using historical Dow Jones Industrial Average data available in Mathematica’s FinancialData function roughly matches the figures in the Times, which used Standard & Poor’s data. (I used the Dow because it’s more convenient, not because I think it’s a better measure.)

But the fact that they are correct doesn’t mean the figures are even remotely meaningful. Here are some problems with the New York Times’ Op-Chart:

First, it gives each president “credit” for stock market performance from the first day of his administration. That’s not reasonable: it surely takes at least a few months if not years before a president’s actions can start to affect the performance of the market.

Second, it completely ignores dividends: in earlier financial eras dividends were much more important than capital gains, and ignoring them distorts the picture.

Third, it ignores inflation: if the stock market was shooting up during a given administration but inflation was also high, the stock market gains may not count for much. Anyone can print money, that’s easy.

Fourth, there is the problem of the great stock market crash of 1929. While it occurred during a Republican administration, and while there were in fact a full eight years of Republican presidents preceding it, there were a lot of other factors involved as well. (McCall acknowledges this problem by including the observation that if you ignore the Great Depression a Republicans-only investment would now be worth $51,211 instead of $11,733.)

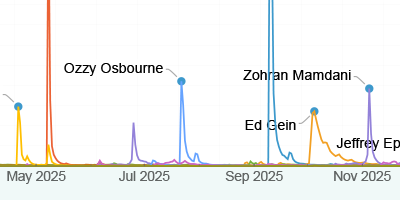

The question is, how representative, or how fragile, is the dramatic result shown in the Times? To help explore this I developed an interactive Demonstration that lets you play with the parameters and assumptions. Here’s what it looks like with the parameters set up to roughly mirror what the Times’ Op-Chart showed. The differences are somewhat less dramatic (I’m using Dow Jones data while McCall used S&P data), but still very substantial, 10 to 1 in favor of Democrats.

(Click each image for a larger popup version.)

But what if we assume that it takes about a year for a president’s policies to take effect? We can move the top slider over to shift the zones for which each party is given credit by one year past the date at which they took office. The difference is suddenly much smaller, less than 50% in favor of Democrats.

Move the point of investment up to 1933, when the economy had started picking up again after the Great Depression, and you get a completely different picture: Republicans ahead by more than 2 to 1.

It gets really interesting if you extend the timeline back and make your initial investment in 1897. Now we see that the crash of 1929 was really the bursting of a bubble: the 12 Republican years of Harding, Coolidge and Hoover were a wild ride, but more or less a wash in the end. (The Dow’s peak in 1929 would not be seen again until 1954! Imagine, 25 years including the worst depression and the greatest war the world has ever seen, and in all that time the stock market never reached the level it had for a few giddy months in 1929. Will it be 25 years before we match the Dow’s high of 2008?)

What if we include the effects of dividend reinvestment? The picture looks similar for a starting point in 1928, though note that the vertical scale is now much higher: diligently reinvesting your dividends multiplies your return by a factor of five or more. (For reasons of data availability these are broad-market figures rather than Dow Jones, and unfortunately we only have them back to 1926 so it’s not possible, in this Demonstration, to compare pre-Gilded Age performance with dividends.)

Now suppose we include the effects of inflation. This makes a tremendous difference, much more so than including dividends. In fact, with an early investment in 1897, it finally puts you ahead if you invested only during Republican administrations. Note also how much smaller the vertical scale is: inflation is a real killer.

OK, enough charts, does any of this mean anything?

You’ve really got to play with it yourself (download the “Stock Market Returns by Party” Demonstration, along with the free Mathematica Player application), but one thing that becomes clear if you do is that you can get just about any result you like by playing with the start date and the assumed lag time before presidential policies start taking effect. There are simply too many factors that go into stock market performance to expect much correlation with presidential parties. (To name just one: which party was in charge of Congress at the time?)

While this is an entertaining Demonstration to play with, ultimately what it shows is that the Times’ Op-Chart, while amusing, is really just one not-very-representative snapshot of a very complicated situation.

And one more thing, notice the little gray figure labeled “Current value under Both”. That’s the figure if you had just left your money in the market the whole time regardless of party affiliation. Notice that it’s much bigger than either the Republican or the Democratic figure. Not a bit bigger, much bigger, so much bigger that if you check the box to graph the “both” curve (basically the index value itself) we have to let it go right off the scale in order to make the other two lines visible at all.

Play with the policy delay slider and you can see the Democratic and the Republican curves fighting it out in the noise at the bottom of the graph while the steady-as-she-goes full-time investment curve towers over them laughing at their silly antics. It doesn’t matter who is in charge, the market is saying, in the long run it’s going to be OK.

interesting material, where such topics do you find? I will often go

Woo! I think i would invest on the market under democratic so i can gain more on stocks.

Thank For Post,Really More informative…..

Why can’t a change in presidency have immediate affects?

Your justification for ignoring a positive correlation is that a president can’t affect markets until they’ve been in office for some time.

But clearly the public’s perception of the government affects the market as well, and that can change instantly.

I think it is foolish to dismiss a correlation out of hand, simply because it suggests something you don’t like.

Your analysis contains some silly analysis, for instance your first “correction” is to shift the data backwards one year. But in fact everyone knows the stock market looks forward, probably by about 6 months. (It’s called the efficient market hypothesis.) Second, academics have taken inflation into account by comparing with bonds, and then the difference is even greater. The more one massages the data (you give *seven* graphs), the easier it is to produce whatever result you want, but even so, you can only get it nearly even. Stick with the cleanest, raw data, and you will be closest to the truth.

Consider two investors, Ms. Blue and Mr. Red, who are ardent believers in their political party. Each investor will 1) reinvest all dividends, 2) move money to a safe savings account on election day when the ‘wrong’ candidate looses, and 3) moves their savings into the stock market on election day when the ‘right’ candidate wins. There was no safe savings account before Glass-Steagall Act of 1933. So before that, we can put investments in a large, heavy safe. Now what happens?

Your posts, are awesome….

I was just listening to Steny Hoyer (dem) quoting the NY Times statistics on C-span. I knew instinctively that there were many factors at play and did a google search. Thanks for doing the analysis. It is work like this that informs versus distorts. Thank you and god bless the internet.

I didnt know that Wolfram could be use as a great tool for new trading strategies. I’ll probably write a blog post about that!

Mike

You failed to mention that if you included BOTH inflation & dividend reinvestments, Democrats would be ahead 10x. Actually, about 20x if you included Obama (DJI gained 54% since he took office).

Right now its a cycle moving towards value stocks instead of growth they do better from now thru elections.

You should add in a way to account for number of years invested.

Obviously “graph both” is the winner, but people study this sort of chart to make an economic comparison of political parties.

The easiest way I can think of would be to just add an average inflation-adjusted return *per-year* for years invested under each party.

I like what you guys are up too. Such clever work and coverage!

Keep up the great works guys I’ve you guys to blogroll.